Joe Banister is the first and thus far only IRS Criminal Investigation Division Special Agent ever to conduct, while serving as a special agent, an investigation into allegations that the IRS illegally administers and enforces the federal income tax. He respectfully reported the results of his investigation to his IRS superiors, up to and including the IRS Commissioner. Rather than address the legitimate concerns raised by one of their own distinguished investigators, his IRS superiors suspiciously refused to address the chilling evidence of IRS wrongdoing raised in his report and instead encouraged him to resign from his position. Observing that IRS management intended to cover up the deceit and illegal conduct alleged in his report, Banister chose to resign from his position so that he could report his findings to the American public. In effect, Banister had to resign from his position in order to abide by his oath to support and defend the U.S. Constitution.

While an IRS agent, Joe was challenged by a radio talk show to disprove the assertion that the federal income tax laws were being illegitimately administered and enforced. Given he and his family’s government service background and the morals and ethics learned during his youth and adulthood, not to mention being mindful of his solemn oath to the U.S. constitution, Joe sensed an obligation to investigate this assertion, even though he privately questioned how it could possibly be true.

What information did Joe encounter during his investigation into the history and details of federal taxation as well as the day to day and inner workings of the Internal Revenue Service and why did the information lead to his resignation from his IRS criminal investigator position? First, a brief summary of his background will be provided, then a few samples of the information he encountered during his investigation will be provided and lastly a summary of the conclusions Joe has formulated for you to review and verify for yourself.

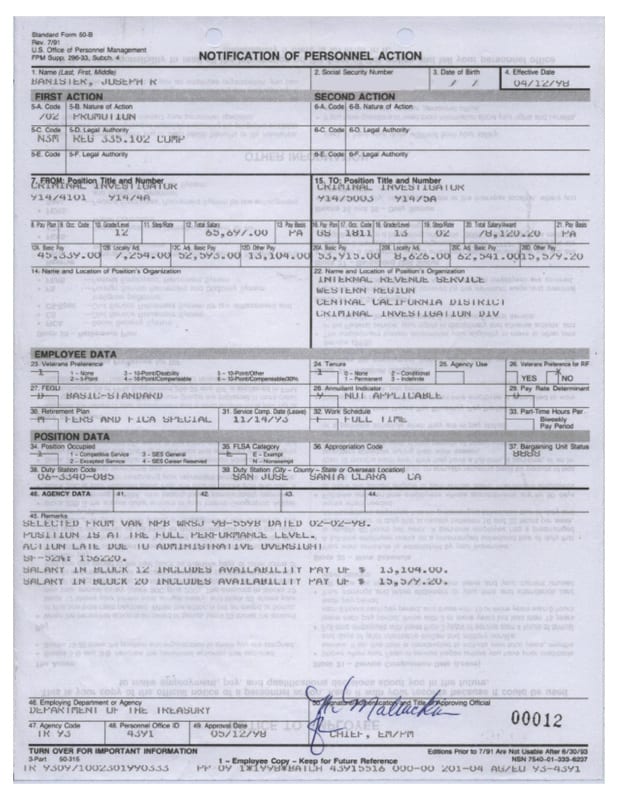

During Joe’s IRS criminal investigator training, he was elected and re-elected president of his law enforcement training classes and received “Academic” and “Expert Marksman” awards. After training and entering into service as an IRS criminal investigator, Joe not only earned a “Special Act Award”, a “Performance Award”, a “Sustained Superior Performance Award” and a “Top Athlete” award but was promoted to the highest non-management grade (“Grade 13”) before even reaching his 5-year employment anniversary (see below for document).

After earning a bachelor’s degree in accounting from San Jose State University and a Certified Public Accountant (“CPA”) license from California, Joseph Banister served for approximately 5 and ½ years as an IRS Criminal Investigation Division Special Agent.

After 2 years of research on his own time and at his own expense, while daily performing his criminal investigation duties, Joe gathered and tested enough evidence to support at least a preliminary conclusion not only that (1) the IRS was administering and enforcing the income tax laws beyond the parameters of the laws passed by Congress and signed by the President and (2) beyond the parameters laid down by the U.S. Supreme Court but also that (3) the IRS’s own internal procedures, manuals and literature itself indicated the IRS was knowingly deceiving the American public about the scope of its true income tax authority. Joe attempted to get answers to these and other questions directly from his IRS supervisors and later by contacting U.S. Department of Justice officials as well as traveling numerous times to Washington, D.C. with other concerned citizens to contact executive, legislative and judicial branch officials directly. Instead of receiving answers to his sincerely conceived and formulated questions and concerns from his IRS supervisors, they instead refused to answer him and encouraged him to resign. Joe did resign from the IRS on February 25th, 1999 after delivering a blistering resignation letter addressed to the IRS Commissioner.

Internal IRS charts reveal an interesting chain of command for typical IRS departments having contact with the public

Internal IRS organization charts indicate that the IRS departments that routinely deal with the American public, in particular the IRS Criminal Investigation Division where Joe served, answer to the IRS “Assistant Commissioner (International)”. (See chart to left)

Internal IRS organization charts indicate that the IRS departments that routinely deal with the American public, in particular the IRS Criminal Investigation Division where Joe served, answer to the IRS “Assistant Commissioner (International)”. (See chart to left)

Why did these internal IRS manual sections I reviewed back in the late 1990s during my service in the IRS Criminal Investigation Division state that the IRS Criminal Investigation Division enforces the criminal statutes applicable to income, estate, gift, employment, and excise tax laws involving United States citizens residing in foreign countries and nonresident aliens subject to Federal income tax filing requirements?

Why did the similar language appear in the IRS manual for the IRS “Examination Division” (i.e., IRS Audit) and for the “Collection Division” and for the Taxpayer Service Division?

Why did the IRS restructure itself beginning in 1998, including the divisions described below, just 4 years before legislation requiring that the federal government use internet-based information technology to enable citizen access to government information, effectively making information such as that presented here accessible by the public with a few mouse clicks? See, for example, the E-Government Act of 2002. Did the IRS fear the American public’s reaction upon reading such information?

These are all questions the IRS refused to answer (4 images – Click to view).

This video explains in more detail my eye-opening personal experiences and surprise during my service in the IRS Criminal Investigation Division whereby I came across internal IRS procedure manuals indicating that the very division in which I worked not only answered to the “Assistant Commissioner (International)” but was described as enforcing income and certain other tax laws “…involving United States citizens residing in foreign countries and nonresident aliens subject to Federal income tax filing requirements…”. The images above are copies of the actual pages of the Internal Revenue Manual I personally photocopied while serving at the Internal Revenue Service. Note how this personnel document depicting one of my later promotions references the “Criminal Investigation Division” as the “Name and Location of Position’s Organization” (middle right of form).

Ordinary Americans Have Never Made Liable To Pay The Federal Income Tax

Federal tax laws follow a distinctive pattern: a tax is imposed and a person is designated as the responsible party to pay the tax that is imposed. Being designated in the law as the person responsible for paying a particular tax imposed is called being made liable for the tax. This dual tax imposition and tax liability pattern is followed over and over again in federal tax law:

- A federal tax is imposed on policies issued by foreign insurers [section 4371] and a person is made liable for the tax imposed on such policies [section 4374].

- A federal tax is imposed on wagers [section 4401(a)] and a person who is in the business of accepting such wagers is made liable for the tax imposed on such wagers [section 4401(c)].

- A federal tax is imposed on distilled spirits produced in or imported into the United States [section 5001(a)(1)] and the distiller or importer of distilled spirits is made liable for the tax imposed on such distilled spirits [section 5005(a)].

- A federal tax is imposed on certain tobacco products manufactured in or imported into the United States [section 5701] and the manufacturer or importer of such tobacco products is made liable for the tax imposed on such tobacco products [section 5703].

There are many other examples of federal taxes that follow the above-illustrated pattern but you get the idea. Believe it or not, the federal income tax follows the same pattern of imposing a federal income tax and also making someone liable to pay the federal income tax imposed. However, it is the limited circumstances in which this liability for the federal income tax arises that exposes part of the huge lie the IRS has told to the American people for decades.

The only law specifying a liability for the federal income tax is found at section 1461 of the Internal Revenue Code. whereby every person required to deduct and withhold any tax under Chapter 3 of the Internal Revenue Code is made liable for such withheld tax. And from whom must such a tax be withheld? Such a tax must be withheld from nonresident aliens [section 1441], foreign corporations [section 1442], foreign tax-exempt organizations [section 1443], Virgin Islands Source income [section 1444], dispositions of United States real property interests nonresident aliens [section 1445] and foreign partners’ share of effectively connected income [section 1446]. How many Americans have any financial dealings whatsoever concerning these types of circumstances? Obviously very few.

What is the reason, then, that in the more than 100 years since the 16th Amendment was conceived, Congress has had plenty of time and opportunity to pass a law and send it to the President’s desk making the average American liable to pay the federal income tax and yet no such law is found in the Internal Revenue Code? If being liable for the federal income tax is not is not a critical legal component of owing the federal income tax, why has the IRS made sure to state in the Form 1040 Instruction booklet and elsewhere since the 1970s that Americans must file a return or statement with the IRS for “any tax you are liable for”?

The Paperwork Reduction Act (“PRA”) requires the IRS to specify the particular laws that require the public to submit certain specified information. The IRS complies with the PRA by publishing the above-illustrated notice, which specifies what those who are made liable for payment of the income tax are required to do. The wording of the above notice proves that the IRS knows very well that only those made liable for the federal income tax are required to pay it. Yet, as explained above, the average American is not engaged in the kind of activities specified in federal law (dealings with non-resident aliens and foreign corporations) that would make them liable for the federal income tax. Is there any obligation to pay a tax for which no law has ever been passed making you liable to pay it? Obviously not. Taxation without representation is a horrible injustice but isn’t taxation without legislation even worse?

The absence of any federal law making the average American living and working in the United States liable to pay the federal income tax and the presence of income tax liability laws surrounding foreign-oriented scenarios helps to explain why the IRS’s internal procedure manuals (described and picture above) limited IRS income tax administration and enforcement to foreign and international matters. The IRS’s own internal procedure manuals offer proof from inside the agency itself that the IRS has no business administering and enforcing the federal income tax laws against the average American living and working in the United States.

The IRS Has Also Deceived The American People About What “Income” Is

The U.S. Supreme Court has ruled dozens of times that the term “income” has a specific constitutional meaning.

Stratton’s Independence, Ltd. V. Howbert, 231 U.S. 399 (1913)

for ‘income’ may be defined as the gain derived from capital, from labor, or from both combined

Doyle v. Mitchell Bros. Co., 247 U.S. 179 (1918)

Whatever difficulty there may be about a precise and scientific definition of ‘income,’ it imports, as used here, something entirely distinct from principal or capital either as a subject of taxation or as a measure of the tax; conveying rather the idea of gain or increase arising from corporate activities

Eisner v. Macomber, 252 U.S. 189 (1920)

Here we have the essential matter: not a gain accruing to capital; not a growth or increment of value in the investment; but a gain, a profit, something of exchangeable value, proceeding from the property, severed from the capital, however invested or employed, and coming in, being ‘derived’-that is, received or drawn by the recipient (the taxpayer) for his separate use, benefit and disposal- that is income derived from property.

Merchants’ Loan & Trust Co. v. Smietanka, 255 U.S. 509 (1921)

The Corporation Excise Tax Act of August 5, 1909 (36 Stat. 11, 112), was not an income tax law, but a definition of the word ‘income’ was so necessary in its administration that in an early case it was formulated as ‘A gain derived from capital, from labor, or from both combined.’ Stratton’s Independence v. Howbert, 231 U.S. 399, 415 , 34 S. Sup. Ct. 136, 140 (58 L. Ed. 285).

Bowers v. Kerbaugh-Empire Co., 271 U.S. 170 (1926)

After full consideration, this court declared that income may be defined as gain derived from capital, from labor, or from both combined, including profit gained through sale or conversion of capital. Stratton’s Independence v. Howbert, 231 U.S. 399, 415 , 34 S. Ct. 136; Doyle v. Mitchell Brothers Co., 247 U.S. 179, 185 , 38 S. Ct. 467; Eisner v. Macomber, 252 U.S. 189, 207 , 40 S. Ct. 189, 9 A. L. R. 1570. And that definition has been adhered to and applied repeatedly.

Taft v. Bowers, 278 U.S. 470 (1929)

Also, this court has declared: “Income may be defined as the gain derived from capital, from labor, or from both combined,’ provided it be understood to include profit gained through a sale or conversion of capital assets.’ Eisner v. Macomber, 252 U.S. 189, 207 , 40 S. Ct. 189, 193 (64 L. Ed. 521, 9 A. L. R. 1570). The ‘gain derived from capital,’ within the definition, is ‘not a gain accruing to capital, nor a growth or increment of value in the investment, but a gain, a profit, something of exchangeable value proceeding from the property, severed from the capital however invested, and coming in, that is, received or drawn by the claimant for his separate use, benefit and disposal.’

Commissioner v. Glenshaw Glass Co., 348 U.S. 426 (1955)

Here we have instances of undeniable accessions to wealth, clearly realized, and over which the taxpayers have complete dominion.

Commissioner v. Kowalski, 434 U.S. 77 (1977)

In the absence of specific exemption, therefore, respondent’s [Trooper Kowalski’s] meal-allowance payments are income within the meaning of 61 since, like the payments involved in Glenshaw Glass Co., the payments are “undeniabl[y] accessions to wealth, clearly realized, and over which the [respondent has] complete dominion.”

For Additional Perspective On Liability For Federal Taxes and The Constitutional Definition Of Income…

A way to understand what the above U.S. Supreme Court cases mean is to picture in your mind an apple tree. A fruitful apple tree has a trunk, branches, leaves and apples. The trunk, branches and leaves of the apple tree are like the “capital” described in the court opinions above and this “capital” of the trunk, branches and leaves of the apple tree enable an “income” of apples to grow, ripen and be picked year after year. The apples plucked from the apple tree represent the “income” or “gain” derived from the capital of the apple tree. The apple tree’s trunk and branches and leaves remain unharmed, intact and alive even though the apples are picked off of the branches. If the trunk, branches and leaves were plucked along with the apples, there would obviously be no more apples next season because the “capital” of the tree was destroyed – no more capital obviously means no more income can be derived from that capital. Whereas, if only the “income” or “gain” of apples derived from the capital of the trunk and branches is separated from the trunk and branches, the capital of the trunk and branches remain able to produce additional apples in the future. Hopefully, this illustration helps to explain why differentiating between “capital” and “income” is so important – capital is not income and income is not capital. Only “income” is taxable and even then only if some federal law has been passed making you liable to pay a tax on such income, which as explained above, has not occurred.

If you would like additional perspective regarding the absence of a statute making the average American liable for the federal income tax, please review the research and analysis authored by (the late) Attorney Tom Cryer here and here.

Watch this video where similar perspectives are presented by myself and 5 attorneys here.

Concluding Thoughts…

What does the above information mean? Well, first keep in mind that the above information is only the tip of the iceberg – there is a mountain of additional evidence that supports the small sample presented above. The above information (and the additional evidence discussed and available here and elsewhere) is what remains of a “paper trail” of deceit perpetrated by Treasury Department and Internal Revenue Service bureaucrats with the willing assistance of elected congressional representatives and senators since at least 1916.

Upon the defeat of the attempt to implement the first income tax in the United States, which resulted from a U.S. Supreme Court case called Pollock v. Farmers’ Loan & Trust Co. declaring the income tax unconstitutional, the advocates for American income taxation went back to the drawing board early in the 20th century and proposed the 16th Amendment to the U.S. Constitution as a way to make income taxation constitutional. The 16th Amendment was allegedly ratified in 1913 (yes, there is solid evidence that the 16th Amendment was fraudulently ratified but that is another discussion) and upon the alleged ratification Congress immediately passed and President Wilson signed into law the Revenue Act of 1913, which for the second time in American history attempted to collect an income tax from the American people.

Unfortunately for advocates of income taxation and the 16th Amendment, the U.S. Supreme Court struck another blow to them in the U.S. Supreme Court decision of Brushaber v. Union Pacific Railroad Co., 240 U.S. 1 (1916). Congress reacted to the Brushaber decision by significantly cutting back on the scope/reach of the 1913 revenue act by repealing the 1913 act and passing another revenue act in October, 1916, whereby only non-resident aliens and foreign corporations were made subject to the federal income tax. It is the 1916 revenue act that formed the foundation for the income tax system we know today. The paper trail from the 1916 revenue act through today is unmistakable. It is this chain of events that led Joe to understand why even internal IRS manuals would actually outline the international nature of the federal income tax – because the Congress retrenched back from taxing the average American living and working in the United States as it tried to do with the 1913 revenue act and instead kept federal income taxation in the “safe zone” of only embracing non-resident aliens, foreign corporations and Americans living/working abroad, all being groups who could not enjoy the constitutional protections of life, liberty and property guaranteed to Americans at home.

***

The IRS has spent massive resources attacking Joe in order to discredit his whistle-blowing efforts. Ask yourself, who would have the greater motivation to lie to the American people, an agency collecting trillions, caught over and over again in lies and deceit, or one man from a family of dedicated government servants, the recipient of numerous awards, who resigned from his position to uphold his oath taken before God to support and defend the U.S. Constitution against all enemies, foreign and domestic?

In his new book, Investigating the Federal Income Tax, you will be astounded at what Banister’s investigation found, what he endured to tell his story to his fellow Americans and the lengths to which the IRS and mainstream media schemed to discredit and silence him, including:

In his new book, Investigating the Federal Income Tax, you will be astounded at what Banister’s investigation found, what he endured to tell his story to his fellow Americans and the lengths to which the IRS and mainstream media schemed to discredit and silence him, including:

- Exposing and unlocking the deceitful and intimidating tactics the IRS uses to make people confused, fearful and compliant.

- Examining IRS internal policy directives and literature, as well as congressional testimony and government reports, casting deep suspicion on the manner in which the IRS administers and enforces the federal income tax system.

- Detailing the corrupt government and media campaign that attempted to re-cast Banister’s sincere whistleblowing efforts as a greedy money-making venture worthy of criminal prosecution and a lengthy prison sentence.

You can help support Joe’s efforts to share the truth about the Federal Income Tax by buying a copy of his new 238 page 8.5×11″ book, with over 100 pages of bonus exhibits.