A rare, naturally occurring metallic chemical element of high economic value. The four primary ones are gold, silver, platinum, and palladium. The Deep State’s manipulation of the gold and silver markets is by far the largest financial coup in history netting its orchestrators more than $1 trillion in stolen profits. It has been and continues to be the perfect crime, because given the Deep State’s capture and control of regulators, prosecutors and legislators, it is never investigated or prosecuted and its plunder therefore comes risk free.

It is impossible that the corrupt, complicit, Deep State-owned and -operated mainstream financial media (MFM) do not know these facts. The reality is that they deliberately fail to break the story, in order to cover up the crime being perpetrated by their masters, the Deep State looters.

As this immensely profitable fraud has been perpetrated, the media has bombarded the populace with a propaganda campaign that smears and mischaracterizes gold. Rising precious metals prices are always presented as being ominous, negative and inimical to the people, while declining prices are consistently placed in a favorable light. This propaganda has been carefully crafted and timed so that when massive, coordinated price attacks occur, market observers actually view them as positive market developments and move on, in the belief that all is well and there is nothing to see.

Whenever true prices start to exert themselves, the MFM go into overdrive to demonize and discredit gold. Truly disgracing themselves, which is increasingly difficult for them to do given the depths to which their fake financial journalism has plunged, they have actually published articles calling gold a “Pet Rock,” and in another instance, a “Ponzi scheme.” By the latter’s idiotic logic, all natural elements and tangible goods are Ponzi schemes, too. If you listen to them, milk and eggs are criminal conspiracies. They know it’s absurd, but they throw the spaghetti against the wall anyhow, to flog the agenda and please their Deep State owners.

In the late 1970s, oil barons Bunker and Lamar Hunt became interested in the favorable fundamentals of silver. They steadily bought the metal, ramping up its price. The Bank State went short against the Hunts, in size. But buying demand persisted, and by January, 1980, silver had reached a record $49.45 per ounce ($147.68 in today’s dollars) and the Bank State was choking on massive paper losses.

The Bank State did what it always does when the chips are down: it lied, cheated and stole. First, it ordered the MFM to character assassinate the Hunts by labeling them greedy profiteers who were attempting to corner the silver market at what would be an exorbitant cost to society. Which was a deliberate lie. Later evidence proved that the Hunts bought silver based upon extensive quantitative analysis that showed it to be significantly undervalued, just as others throughout history have been attracted to undervalued assets. There was no evidence at all that the Hunts were trying to corner the silver market. But the media onslaught overwhelmed the truth, and set the stage for Act 2.

In Act 2, the Bank State ordered its’ captured, bribed CFTC regulators to change silver futures rules so as to force the Hunts to liquidate their positions. Predictably, silver’s price plunged from $49.45 to $10.80 between January and March, 1980, as a result of the out-of-the-blue, “liquidation only” CFTC mandate. This wiped out the Hunts and bailed out the Bank State of its massive losses, which, of course, was the corrupt point of the exercise.

In the process, the Bank State saw first-hand the enormous profit potential inherent in precious metals price manipulation. And it raced to invent a new form of alchemy that would enable it to make those potential profits go exponential: the transmutation of printed paper and costless, ethereal computer digits into what they would say were the equivalent of physical gold and silver. Honest precious metals price discovery died when the Hunts were cheated and fake gold and silver were invented. The precious metals futures market has been an organized crime scene ever since.

Prior to the Deep State’s successful overthrow and corruption of the metals market, gold and silver reached 1980 highs of $850 and $49.45, respectively. We regard those as legitimate prices that actually would have been exceeded if the free market had prevailed. Fundamental forces were enormously bullish for metals at that time, and have been so ever since.

Using the U.S. government’s inflation statistics, which are deliberately understated and therefore conservative, today’s prices would be $2,510.55 for gold and $147.68 for silver. Therefore, current fake gold and silver prices are roughly $1,300.00 and $130.00 per troy ounce beneath their 1980 inflation adjusted highs, respectively. This is extraordinary given the radical deterioration of monetary, financial, fiscal, economic and geopolitical conditions since 1980. Prices should now be far above the 1980 inflation-adjusted highs, not far below them.

With 5.8 billion ounces of owned physical gold in the world, the ~$1,300 per ounce price oppression results in an aggregate gold market undervaluation of $7.54 trillion. And with 20.5 billion ounces of owned physical silver in the forms of jewelry, silverware, coins, bars and rounds, the $130 per ounce price oppression amounts to an additional market undervaluation of $2.67 trillion. Combined, this totals $10.21 trillion that has been stolen from the owners of gold and silver worldwide as a result of the Deep State’s price manipulation fraud. This $10.21 trillion amount is an absolute minimum, because for dozens of objective, quantifiable reasons, gold and silver prices should exceed their 1980 inflation adjusted highs by at least two and up to four times. Therefore, the true cost to the global owners of gold and silver is actually in the range of $20 to $40 trillion. The people have paid a staggering price for the Deep State’s precious metals crime spree, as there is no fraud in history whose financial impact even comes close to this. Yet the corrupt MFM doesn’t say a word.

From 2009 through 2013, former Goldman Sachs partner Gary Gensler, protégé of (among others) Robert Rubin (former U.S. Treasury Secretary and now Chairman of the Council on Foreign Relations, the embodiment and epitome of the Deep State) and Larry Summers (also a former U.S. Treasury Secretary (put there by his mentor, Robert Rubin), Group of 30 member and a leading Deep State cash elimination mouthpiece), was the Chairman of the Commodities Futures Trading Commission (CFTC). During virtually his entire tenure, the CFTC conducted a so-called investigation into silver market price manipulation. In 2013, the CFTC closed the investigation, saying it had not found any improprieties whatsoever, not even one. According to them, the silver market was squeaky clean.

In 2016, completely without any CFTC involvement, Deutsche Bank admitted that it and numerous other major, international, SIFI (Significantly Important Financial Institution, aka, Too Big to Fail) banks had massively manipulated the silver market for years, including during the entire duration of the CFTC’s fake investigation. A few days later, Deutsche Bank admitted that it and numerous other SIFI banks had also rigged the gold market.

Gensler left the CFTC in early 2014, and went to work for Hillary Clinton’s presidential campaign. In 2015, he was named Chief Financial Officer of her campaign. A Clinton victory was fully expected, and it was understood that Clinton would name Gensler Secretary of the Treasury. (Now do you see how this works?) In that role, he would have been far more helpful to the Deep State than he was in his CFTC role of protecting their $1 trillion precious metals fraud from being exposed or interfered with. In the Treasury Secretary position, the top marching order from his Deep State masters would have been simple and clear: get cash eliminated once and for all, and we will make you richer than you can ever imagine. He would have been all over it.

That prices in the precious metals markets are manipulated is not speculation, it is fact, a fact made clear again recently by the Commodity Futures and Trading Commission´s (CFTC) ruling against investment bank Merrill Lynch Commodities Inc (MLCI) for spoofing pricing of gold and silver futures contracts on the COMEX exchange. The number of investigations, legal cases, class actions and financial headlines involving precious metals manipulation are now so pervasive that it’s hard to keep track of which cases are in motion and which investment banks are under scrutiny at any given time.

But beyond the profit and greed driven bullion bank manipulations gold and silver prices, there is also the issue of central bank policy interventions to suppress the gold price by outright gold sales or using the opaque and secretive gold leasing and lending market. This is a less talked about manipulation given the secrecy of everything to do with central banks and gold, as well as a reluctance of the financial media to broach the subject and a reluctance of regulators to ‘go there’ by even looking at central bank gold market activities.

That central bank operations in the gold market have existed is also fact, with such operations covering price smoothing and price stabilization, price pegging, and coordinated gold pools. See BullionStar articles “New Gold Pool at the BIS Basle, Switzerland: Part 1” and “New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil” and “The Bank of England and the London Gold Fixings in the 1980s” for more background. There is also ample evidence about central bank manipulation documented in various places including on the GATA website. The motivations for such central bank interventions include protecting the existing financial system, engineering low real long term interest rates, and preventing gold acting as a barometer of inflation.

But beyond even commercial bank manipulation of gold and silver metals prices and central bank policy manipulation of gold, there is arguably another form of manipulation in the precious metals markets which is far more influential in subduing price discovery and which takes the form of the very structure of how these markets trade vast quantities of futures contracts and synthetic and paper gold and silver positions that are completely unconnected with any underlying physical metal. The home of this trading is of course on the US COMEX exchange and the unallocated gold and silver markets in London. Both venues of which are ruled by the LBMA bullion banks.

Merill ´Spoofing´ Lynch

Turning first to the recent Merrill Lynch case, in late June this year the CFTC announced that it had fined Merrill Lynch Commodities Inc (MLCI) $25 million for manipulating gold and silver futures contracts on the COMEX exchange between 2008 and 2014. This was done ‘thousands of times’ according to the CFTC, by MLCI traders ‘spoofing’, or placing and then cancelling orders before they were executed. By creating artificial demand or supply and thus false prices, this interfered with the (already broken) precious metals price discovery that would have otherwise occurred.

Interestingly though not surprisingly, much of the direct evidence the CFTC used in its verdict was from the myriad log files of trader chat apps which were used to coordinate the spoofing. For example, in one 2010 chat, a trader was quoted as saying “guys the algos are really geared up in here. [I]f you spoof this it really moves . . .”.

While a lot of money for most people, a $25 million fine is a paltry amount for a global investment bank such as Merrill Lynch and is just a cost of doing business on bank-ruled Wall Street. However, the ruling at least demonstrates that what many always thought about precious metals futures price discovery as being rigged and manipulated is in fact correct. As well as the $25 million fine, Merrill entered into a non-persecution agreement with the US Department of Justice (DoJ), agreed to cooperate with the DoJ investigation into criminal violations, paid a $11.5 million civil monetary penalty to the CFTC, and had indictments against two of its former MLCI precious metals traders, Edward Bases and John Pacilio.

The Usual Suspects – UBS, HSBC and Deutsche

But the recent case against Merrill is not an isolated event. It follows similar moves by the CFTC in early 2018 where the CFTC charged investment banks UBS, Deutsche Bank and HSBC and a number of their traders for spoofing precious metals futures from as early as 2008, while fining the banks a combined $46.6 million (of which $30 million was levied against Deutsche, and $15 million against HSBC). In those cases, the CFTC worked with the US Department of Justice and the FBI to bring the charges.

Moving forward to this year, in February 2019, the U.S. District Court for the District of Connecticut fined ex UBS precious metals trader Andre Flotron $100,000 for price spoofing and price manipulation in violation of the Commodity Exchange Act (CEA) and CFTC Regulations. In that action, the CFTC found that Flotron had spoofed large orders in the precious metals markets between “at least August 2008 through at least November 2013, while employed at UBS”. This followed the CFTC reopening the case against Flotron in December 2018.

For excellent insights into how these UBS and other investment bank traders operated their spoofing, see the articles by Allan Flynn from April 2018 titled “US Gold and Silver Futures Markets – ‘Easy Targets’” and “UBS and Deutsche Bank gold and silver traders, April 2018”. For example, in evidence at the Flotron trial, Mike Chan, a UBS junior trader to Flotron while they worked in Singapore stated to the court that “during training, I’d seen him spoof and – enough that I replicated it immediately to do the same thing. And as my career progressed at UBS, the more traders I interact with, the more people I’ve seen spoof.”

The Fix is In – Manipulating the Gold and Silver Benchmarks

Beyond the gold and silver futures markets, but interfacing with the futures, a similar group of bullion bank traders are, not surprisingly, also involved in antitrust court cases alleging that these banks manipulated the London gold and silver fixing benchmark auction prices. While these cases are still winding their way through New York courts, and have not yet been fully ruled on, the chat room transcripts on manipulative price collusion can only be described as shocking, chat transcripts which anyone who bothered to think about it knew they existed from at least 2004.

The cases in question have been brought by groups of precious metals investors against the cartelesque London Gold Fixing and London Silver Fixing companies with allegations that Bank of Nova Scotia and HSBC manipulated silver fixing prices from 2007 to 2013, and that ScotiaBank, HSBC, Barclays and Societe Generale manipulated fixing prices from 2004 to 2013. Noticeably absent is Deutsche Bank which settled its way out of both cases, and UBS which successfully dismissed itself from both cases using cooperation and expensive lawyers.

Again we turn to an article by Allan Flynn from December 2016 titled “How to Trigger a Silver Avalanche by a Pebble: ‘Smash(ed) it Good’ which has a host of excellent quotes from chat room transcripts on how traders allegedly manipulated the silver market, for example:

UBS Trader A: “gonna bend this silver lower”; “i will bend it lower told u”; ”hah cool its gonna get ugly”; “use the blade on silver rg tnow it’ll hold it up”, “gona blade silver now.”

Deutsche Bank Trader B instructing Barclays trader A: “today u smash,”

UBS Trader A: “an avalanche can be triggered by a pebble if you get the timing right” and “silver still here, u can easily manipulate silver”

With the cases against the London Gold and Silver Fixing companies still in discovery in the New York courts, expect further revelations later this year, but given the leniency of the system, not a lot of penalties.

For those readers alert to the way trading of precious metals futures contracts and trading around the London gold and silver fixes works, you will see that the pushing around of prices occurs in both ‘venues’, on COMEX and in the London gold and silver market, especially in the lead up to and during the fixes.

The same investment bank precious metals traders trade gold and silver futures contracts and London OTC contracts, and they trade these in the London and COMEX ‘venues’ at the same time. Price movements in one location instantly are reflected in the other. This is all explained in the BullionStar article “Spoofing Futures and Banging Fixes: Same Banks, Same Trading Desks” from April 2018. At the time I said the following, which is even more apt now given the CFTC’s recent prosecution of Merrill Lynch Commodities Inc (MLCI):

“Prosecuting banks and traders for price manipulation on COMEX futures while ignoring the far larger London market and its gold and silver fixings looks like a job half done. Trading desks and their traders are agnostic to trading venues and with interlinked markets, the COMEX and the London Fixings are two sides of the same coin.”

Conclusion – The Greatest Trick ever Pulled

Manipulating gold and silver prices by spoofing futures trades and cancelling them is one thing. Central bank intervention into physical gold markets to dampen the gold price is another. But perhaps the most far reaching yet unappreciated method of manipulation is sitting there in plain sight, and that is the very structure of the contemporary ‘gold’ and ‘silver’ markets where prices are established by trading in vast quantities of fractionally-backed synthetic gold and silver credit, be it in the form of vast quantities of unallocated positions that are ‘gold’ or ‘silver’ in name only, or in the form of gold and silver futures which haven’t the slightly connection with CME approved precious metals vaults and warehouses.

By siphoning off demand for real gold and silver and channeling it into unbacked or fractionally-backed credits and futures, the central banks and their bullion bank counterparts have done an amazing job in creating an entire market structure of futures and synthetics trading that is unconnected to the physical gold and silver markets. This structure siphons off demand away from the physical precious metals markets, and in doing so, creates a system of price discovery which is nothing to do with physical gold and silver supply and demand.

Apart from fractional-reserve banking, precious metals market structure is perhaps one of the biggest cons on the planet. So next time you think of precious metals manipulation, remember that in addition to spoofing and secretive central bank gold loans, the entire structure of the precious metals markets is unfortunately one big manipulation hiding in plain sight.

Sources:

- BullionStar.com website under the same title “Gold & Silver Price Manipulation – The Greatest Trick ever Pulled“

- http://news.goldseek.com/GoldSeek/1489601367.php

Chronological History of Events Related to Precious Metals

The Hague Agreement of 1930: The Formation of the Bank of International Settlements by the Central Banks Under the Auspices of German Reparation Payments for WWI

“The Bolshevik Revolution in Russia was the Work of Jewish Planning and Jewish Dissatisfaction. Our Plan is to Have a New World Order.”

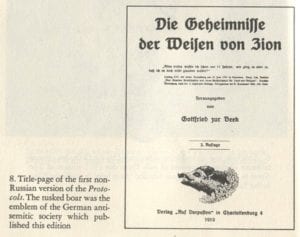

‘The Protocols of the Meetings of the Learned Elders of Zion’ Excerpts Were First Published in Serialized Form, in a St. Petersburg Newspaper. Were They Authentic?

The Second Boer War

The Panic of 1893: Boosting Bankers’ Money and Power

U.S. President James Garfield is Shot by an Assassin