Together with its sister organizations in Britain and elsewhere around the world, these groups would work together toward what they called a “New World Order” of total financial and political control directed by the bankers themselves. As Carroll Quigley, noted Georgetown historian and mentor of Bill Clinton, wrote in his 1966 work, Tragedy and Hope: A History of The World In Our Time:

“The powers of financial capitalism had [a] far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences. The apex of the system was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations.”

This is why the bankers and their partners in government and business conspired to bring about the 2008 crisis. Not for the pursuit of money, but power. In the same way the bankers used the Panic of 1907 to consolidate their control over the money supply, they hope to use the 2008 crisis and subsequent panics, which they themselves have created, to consolidate their political control.

The inevitable conclusion, one that flows necessarily from the true understanding of this situation, is that the Federal Reserve system needs to be consigned to the dustbin of history. After a century of enslavement, it is time for the American public to finally throw off the bankers’ debt chains.

Andrew Gavin Marshall: If there was ever a point in human history to start questioning alternatives, this would be it. And to think that where we are…and simply say “Oh, well this is the best of our options,” how many of the best options lead to self-destruction? Doesn’t sound like a best option.

I think that with a world of seven billion people we can probably come up with something better than a system in which a few thousand people benefit so much at the expense of everything else on this world and at the expense of the potential for the future of mankind. They’re leveraging our future and so long as we accept this way of thinking, so long as we accept these institutions as having dominance, that’s the direction we’ll be going.

So I think reform is a good way to try and stall and to push back directly against the expanding and evolving power structures, but radical change is what’s really needed and that has to be built from the bottom up. But I think that these two processes can and should go together in parallel.

If you’ve made it this far, congratulations. You are now better informed on the economic history of the United States and the truth about the Federal Reserve than 99% of the population. If you do nothing else, then just working to get those around you educated on this information alone will have a profound effect. Once they learn of the scam, many are motivated to do something about it, and they, in turn, inform others. This is the viral nature of suppressed truth, and it is the reason that more people are aware of and energized by the issue of the Federal Reserve and the nature of money than ever before.

Perhaps even more amazingly, this movement is spreading to other parts of the globe. Recognizing the interlocking nature of the modern global economy, and the international nature of the banking oligarchy, movements to abolish the Federal Reserve have sprung up in Europe, where protests against the cartelized central banking system are taking place in over 100 cities attracting 20,000 people on a weekly basis.

Lars Maehrholz: I started this movement because I realized that the Federal Reserve Act, in my opinion, is one of the worst laws in the whole world. So a private banking company is lending America the money, and in my opinion is not democratic anymore. The Federal Reserve tells the government what to do, and that’s the problem.

Luke Rudkowski: It’s a very big problem, especially in the U.S. Why is it a global issue, and why are people doing it here in Germany?

Lars Maehrholz: Because when you realize that this finance system, it’s a global system, you have to go really to the beginning of the system. And in my opinion it’s also the World Bank and the International Monetary Fund and stuff like this, but at the beginning of all this is a law from 1913. Woodrow Wilson signed it, and this is the beginning of all this hardcore capitalism we are now suffering from. And the only way to stop this is maybe to break this law.

SOURCE: Establishment is Afraid of End The Fed Movement in Germany

But what if the burgeoning movement to End The Fed is successful? What system do people propose as the answer? There have been several proposals along different lines by various researchers. Some argue for a return to America’s colonial roots of debt-free money issued by state run banks, pointing to the Bank of North Dakota as one already functioning, successful model of this approach.

Ellen Brown: We’ve had two banking systems ever since the 1860’s with the state bank system and the federal bank system, and the federal bank system are the big Wall Street banks particularly. They dominate the federal system. So, they’re taking over right now. In California we don’t even have any local banks where I am. We had two and I had accounts in both of them and now one of them is Chase Bank and the other is U.S. Bank. So they’re both big Wall Street banks now that have been taken over.

So it’s the local banks that have an interest in serving the local business. The big banks have no interest in making loans to local businesses; it’s too risky, why should they bother? They’ve got this virtually free money they can get from the Fed and from each other and it’s much more lucrative to them either to speculate in commodities or other thing abroad, or what works very well for them is to buy long-term government bonds at 3% because these have no capital requirement. The capital requirements for government bonds are zero. So they can buy all of those that they want. Whereas if they make loans for mortgages or they make loans to businesses then they have to worry about the capital requirement and as soon as they’ve used up all their capital–in other words eight dollars in capital will get you a hundred dollars of loans–then they can’t make any more loans they have to wait for thirty years for the loans to get paid off. So what they if they do if they do buy mortgages is sell them off too investors and so that’s the whole mortgage backed security scam that we’ve seen. They had no motivation to make sure that these borrowers were actually sound borrowers; they just wanted to make a sale. So they sold the stuff to the unwary investors who might be somebody in Iceland or Sweden or pension funds. So that didn’t work out so well.

So a state bank partnering with the local banks can provide the capital. It can help them with capital. In North Dakota the state bank guarantees the loans of the local banks, allowing them to make much bigger loans than they could otherwise. The state bank provides liquidity to the small banks. That’s why the local banks aren’t making loans to small business right now, because they don’t know that they can get money from the other banks as needed. The way banking works is they make the loan first. I mean, if you have credit lines to many different businesses and if they all hit up their credit lines at once you are going to run out of money. So you don’t dare do that unless you know that you can get short-term loans from the other banks. And so what’s happening right now, even though there’s $1.6 trillion is excess reserves sitting on the books of the big banks, they’re not available to the little banks and the reason is because the Fed is paying 0.25% interest on those reserves. So the banks have no incentive to lend them to the little banks. Why let go of them when you can make just as much keeping them and then you still have your reserves and you can use them as collateral to buy bonds or something that’ll make you more money?

So the whole system is messed up and in North Dakota, the bank of North Dakota provides liquidity for these local banks.

Others advocate a decentralized system of alternative and competing currencies that greatly reduce or even eliminate altogether the need for a central bank.

Paul Glover: Well, 22 years ago in Ithaca, New York I noticed there were a lot of people, friends particularly, that had skills and time that were not being employed or respected by the prevailing economy. While we had much desire to create things and trade them with each other and many services we could provide to each other, we didn’t have the money. So since I have a background in graphic design, journalism and arrogance I went to my computer and designed paper money for Ithaca, New York. I designed pretty colourful money with pictures of children, waterfalls and trolley cars denominated in hours of labor. One-hour note, half-hour, quarter, eight-hour notes and two-hour notes. I then began to issue to each of those pioneer traders who had agreed to being listed in the directory a specific starter amount, and the game began. An hour has been worth basically $10 U.S. dollars which at that time 20 years ago was double the minimum wage. People who usually expect more than $10 per hour of their service can charge multiple hours per hour but the denomination puts between us as residents of our community, that reminds us that we are fellow citizens, not merely winners or losers scrambling for dollars. It introduces us to each other on the basis of these skills and services that we have, that we are more proud to provide for each other than often is the case with a conventional job. Just the stuff we have to do to get the money to pay the bills.

So through that trading process, that more intimate scale process within the community, we’re more easily able to become friends and lovers and political allies.

James Corbett: It’s an inspiring story and tell people about how much money has circulated through this community. I mean, it’s important for people to understand just how successful this has been.

Paul Glover: Because we are not a computer system we don’t have a specific volume of trading recorded but by the grapevine, by phone surveys and over the years watching the money move we were able to guess very reliably that several million dollars equivalent of this money has transacted over those years. Making loans without charging interest up to $30,000 value, which is the fundamental monetary revolution in our system. Then as well, making grants of the money to over a hundred community organizations.

SOURCE: Avoiding Economic Collapse: Complementary Currencies

Some argue for currencies whose mathematical nature prevent them from being merely conjured into existence whenever a federal government wants to wage another war of aggression or forge another link in the seemingly endless train of governmental tyranny and abuse.

Roger Ver: What people have to understand about Bitcoin is that it’s a completely decentralized network. There’s no central server, there’s no controlling company, there’s no office, it’s just free software that anyone can download and start running on their computer anywhere in the world. And that the Bitcoins themselves can be transferred to or from anyone, anywhere in the world and it’s impossible for any bank or government or entity to block you from sending or receiving those Bitcoins. There’s a limited supply of those Bitcoins, there will never ever be anymore than 21 million Bitcoins. So, like everything the price is set based on supply and demand. Because the supply of Bitcoins is limited and the demand is increasing as more and more people start to use them and more and more websites start to accept them, the price of Bitcoins in terms of dollars is going to have to increase, even a lot more than the $500 per Bitcoin that it is today.

James Corbett: Are there any drawbacks at all to the idea of using a crypto-currency?

Roger Ver: If you’re part of the current power elite that can just print money at will to spend on whatever you feel like then yeah, the world switching over to Bitcoin is probably not going to benefit you. But if your one of the normal people that aren’t working for the Federal Reserve or any central bank that’s printing money to pay to your friends and that sort of thing, then a Bitcoin world is a wonderful thing for you.

SOURCE: How to Defund the System: Bitcoin vs. the Central Banksters

Sound money. Cryptocurrencies. State banks. LETS programs. Self-issued credit. These and many other solutions have all been proposed and many of them are in use in different localities today. Information on all of these ideas and how they are being applied in various parts of the world are widely available online today. The point is that the question of what money is and how it should be created is perhaps the single greatest question facing humanity as a whole, and yet it is one that has been almost completely eliminated from the national conversation…until recently.

For the first time in living memory, people are once again rallying around the monetary issue, and American politics stands on the threshold of a transformation almost unimaginable just two decades ago.

And so the rest of the story is now in our hands. Once we understand the scam that has taken place, the gradual consolidation of wealth and power in the hands of an elite few banking oligarchs and the growing impoverishment of the masses, all in the name of banking funny money created out of nothing and loaned to the public at interest, we can choose to get active or to do nothing at all.

For those who choose to get active, there are some steps that you can take to help change the course of this system:

1) Follow the links and resources from the transcript of this documentary at corbettreport.com/federalreserve to familiarize yourself with the history, the connections and the functions of the Federal Reserve system. If you can’t explain this material to yourself then you will never be able to teach it to others.

2) Begin reaching out to others to bring them up to speed on the issue. It can be as simple as broaching this conversation in the Monday morning water cooler talk or passing out a copy of this documentary or sending out links to this information to your email list. Insert this topic into your conversations. When people start talking about the national debt or the state of the economy or other political talking points, get them to question the roots of these issues, and why there is a national debt at all.

3) When you are able to find or create a group of like-minded people in your area who are engaged with the issue, start a study group on the issue and its solutions. The study group can help source alternative or complementary currencies in the local area, or, if none exist already, the group can form the basis for a community of local businesses and customers who are willing to start experimenting with ways to wean themselves off of the Federal Reserve notes.

4) Use the resources at corbettreport.com, including the Federal Reserve information flyer, or hold DVD screenings, to attract interest in your group and draw others into studying the true nature of the monetary system.

The work of building up an alternative to the current system can seem daunting, even at times overwhelming. But it’s important to keep in mind that the Federal Reserve system that seems so monolithic today has only been around for one century. Central banks have been defeated in America before and they can be defeated again.

The question of how we decide to change this system is not rhetorical; it will either be answered by an informed, engaged, active population working together to create viable alternatives and to dismantle the current system, or it will be answered by the same banking oligarchy that has been controlling the money supply, and indeed the lifeblood of the country, for generations.

Now, one century after the creation of the Federal Reserve system, we have a choice to make: whether the next century, like the one before it, will be a century of enslavement, or, transformed by the actions and choices that we make in the light of this knowledge, a century of empowerment.

Source: https://www.corbettreport.com/federalreserve/

Additional Reading:

- ‘SECRETS OF THE FEDERAL RESERVE, The London Connection’; By Eustace Mullins

- How The Federal Reserve Came To Power

Videos:

- The Creature from Jekkyl Island

- G. Edward Griffin: A Second Look at the Federal Reserve

- America: Freedom to Fascism (below)

Chronological History of the Federal Reserve and Related Events

Louis McFadden Introduces Impeachment Resolution for the Federal Reserve Traitors who Colluded to Cause the Great Depression and Steal $80 Billion from the US Gov’t

Executive Order 6102 – The Great Gold Robbery of 1933: FDR and the Federal Reserve Confiscates All Gold in Exchange for Depreciable Fiat Dollars

The Emergency Banking Act and the Bankruptcy of America: A Lot More Happened as a Result of this Act Than Just the Confiscation of the People’s Gold

Louis McFadden: “The Federal Reserve banks are… the Most Corrupt Institutions The World has Ever Seen. They are not Government Institutions (but) Private Credit Monopolies…”

Louis McFadden Introduces a Resolution Indicting the Federal Reserve Board for “Having Treasonably Conspired and Acted Against the Peace and Security of the US”

The Hague Agreement of 1930: The Formation of the Bank of International Settlements by the Central Banks Under the Auspices of German Reparation Payments for WWI

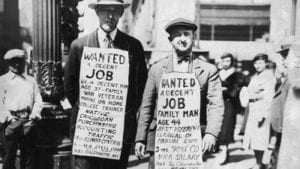

Black Tuesday Marks the Beginning of the Great Depression: A Ten Year Crisis Engineered by International Bankers.

The New York Times Headlines Read, “Federal Advisory Council Mystery Meeting in Washington” Just Prior to the Market Crash

Hearings on a Stabilization Amendment to the Federal Reserve Act Concluded with Warnings that a Financial Crash had Been Planned in 1927 by the International Bankers