Between March 1-17 of 2010, IRS agents identified the first 10 “Tea Party case” applications though not all had “tea party” in their name, according to a draft of The Treasury Inspector General for Tax Administration (TIGTA) appendix. IRS’ Determinations Unit had asked for a search of “tea party or similar organizations’ applications.” Through 2015, an investigation had learned that “tea party” and “patriot” organizations were flagged, donor lists requested, tax exemption denied, thousands of emails deleted and backups destroyed, that IRS Commissioner and officials frequently visited the white house during this time although Obama and cabinet deny any knowledge of the scandal.

In Charles Johnson’s thrilling book, The Truth About the IRS Scandal, we learn that, Lois Lerner, the woman at the center of the congressional probe into the targeting of conservative groups, called the Tea Party “very dangerous” and hoped it could be used to roll back a court case, Citizens United v. Federal Election Commission (2010). Lerner conspired with her old colleagues at the FEC to leak confidential tax information. She even acted to retroactively award tax exempt status to politically connected charities while targeting for destruction those committed to truth.

Forbes details events leading up to the scandal:

July 2008: In the run-up to the presidential election, Citizens United, a conservative lobbying group, wants to air a series of commercials promoting a film targeting Hillary Clinton, who was seeking the 2008 Democratic presidential nomination. The United States District Court for the District of Columbia ruled that they couldn’t, finding that it was a violation of the Bipartisan Campaign Reform Act of 2002 (also known as the McCain–Feingold Act). The group appealed. (Forbes)

July 2008: In the run-up to the presidential election, Citizens United, a conservative lobbying group, wants to air a series of commercials promoting a film targeting Hillary Clinton, who was seeking the 2008 Democratic presidential nomination. The United States District Court for the District of Columbia ruled that they couldn’t, finding that it was a violation of the Bipartisan Campaign Reform Act of 2002 (also known as the McCain–Feingold Act). The group appealed. (Forbes)- March 24, 2009: The Supreme Court agrees to hear the case, and oral arguments begin in Citizens United v. Federal Election Commission. Theodore B. Olson, who successfully represented former President George W. Bush in Bush v. Gore, represents Citizens United. Malcolm L. Stewart of the Department of Justice represents the government. More than 40 briefs amicus curiae were filed, including those from Sen. John McCain (R-AZ), Sen. Mitch McConnell (R-KY), the Institute for Justice and the NRA. (Forbes)

- January 21, 2010: The Supreme Court issues an opinion reversing the original decision in part, affirming the matter in part and remanding it back to the lower court. The Court finds that it is unconstitutional to ban all free speech by corporations, unions, and other organizations – even as it applied to political campaigns. As a result of the ruling, the number of nonprofit organizations applying for tax-exempt status under section 501(c)(4) of the Tax Code increases dramatically. (Forbes)

- August 2010: To deal with the increase, the IRS distributes its first formal BOLO (Be on the Lookout) listing for purposes of reviewing applications. Initially limited to Tea Party organizations applying for tax-exempt status, it widens over the next year to include more groups, and specific policy positions such as government spending and taxes. By 2011, acting Director of Exempt Organizations, Lois Lerner, is advised of the practice. The use of BOLO lists continues until June 12, 2013. (Forbes)

- October 26, 2010: Determinations Unit personnel emailed concerns about the additional review process for tea party applications to the Technical Unit. This individual follows up in November when response to concern about consistency yields no change. (Infowars.com)

- June 29, 2011: IRS director of exempt organizations Lois Lerner learns at a meeting that the agency flagged group titles with “tea party,” “patriot,” or “9/12 Project” for supplementary review. She told those involved to alter this practice “immediately,” according to a draft of the report from the TIGTA, who audits the IRS. (Infowars.com)

- Jan. 25, 2012: IRS changes standard for identifying organizations that require additional scrutiny, now flagging for “political action type organizations involved in limiting/expanding Government, educating on the Constitution and Bill of Rights, social economic reform movement,” according to the inspector general’s report. (Infowars.com)

March 22, 2012: As the issue is made public (but attracts little notice), then serving IRS Commissioner Doug Shulman testifies in front of the House Ways and Means Subcommittee on Oversight that there was “absolutely no targeting” by the IRS of conservative and Tea Party organizations. Two months later, Shulman, together with former Acting Commissioner Steven T. Miller, is briefed by Treasury Inspector General for Tax Administration (TIGTA) about the matter. (Forbes)

March 22, 2012: As the issue is made public (but attracts little notice), then serving IRS Commissioner Doug Shulman testifies in front of the House Ways and Means Subcommittee on Oversight that there was “absolutely no targeting” by the IRS of conservative and Tea Party organizations. Two months later, Shulman, together with former Acting Commissioner Steven T. Miller, is briefed by Treasury Inspector General for Tax Administration (TIGTA) about the matter. (Forbes)- June 2012: Following up on complaints about delays in processing tax exempt applications, Rep. Darrell Issa (R-CA CA -0.28%) formally requests a TIGTA inquiry. The inquiry begins one month later but the findings will not be published until May 2013. By that time, Shulman stepped down, months after telling a crowd at the National Press Club that the key to managing the IRS was “a relentless and myopic focus on priorities — not getting distracted by too many crises or incoming demands.” (Forbes)

- April 30, 2013: In the full notes of an April 30 meeting (discovered in a FOIA request from Judicial Watch), John McCain’s high-ranking staffer Henry Kerner recommends harassing non-profit groups until they are unable to continue operating. Kerner tells Lerner, Steve Miller, then chief of staff to IRS commissioner, Nikole Flax, and other IRS officials, “Maybe the solution is to audit so many that it is financially ruinous.” In response, Lerner responded that “it is her job to oversee it all:”

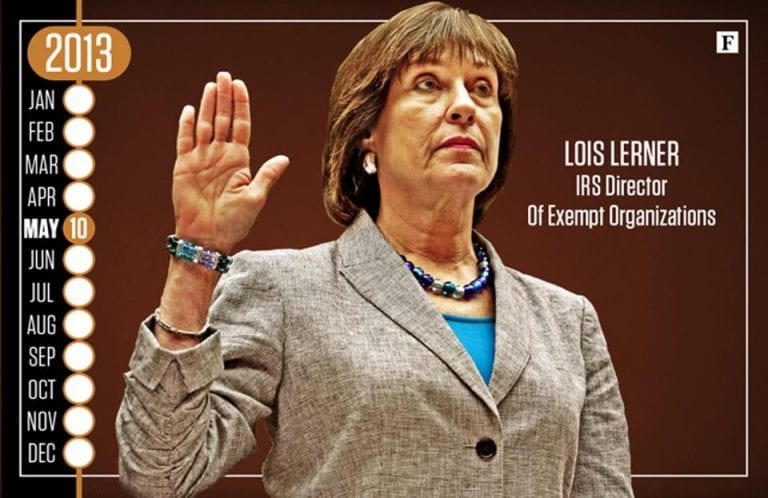

May 10, 2013: During an American Bar Association (ABA) meeting, then acting Director of Exempt Organizations, Lois Lerner, responds to a question from the audience that some have since suggested was planted. Lerner responds, admitting that organizations were targeted by beliefs, and said “They selected cases simply because the applications had [Tea Party or Patriots] in the title. That was wrong, that was absolutely incorrect, insensitive.” (Forbes)

May 10, 2013: During an American Bar Association (ABA) meeting, then acting Director of Exempt Organizations, Lois Lerner, responds to a question from the audience that some have since suggested was planted. Lerner responds, admitting that organizations were targeted by beliefs, and said “They selected cases simply because the applications had [Tea Party or Patriots] in the title. That was wrong, that was absolutely incorrect, insensitive.” (Forbes)- May 14, 2013: The pace of investigations increases markedly as TIGTA announces its findings. On May 14, 2013, Attorney General Eric Holder announces that the FBI is pursuing an investigation into the matter. The following day, the IRS issues a statement on the scandal, and acting IRS Commissioner Steven Miller announces his resignation. After Miller’s resignation, President Obama appoints 42-year-old Daniel Werfel to the position of Acting Commissioner of the IRS. (Forbes) Werfel has been the controller of the White House’s Office of Management and Budget since 2009. (Infowars.com)

- May 17, 2013: Steve Miller and TIGTA Inspector General J. Russell George appear at a hearing in front of the House Ways and Means Committee, maintaining that what happened was “inappropriate” but not illegal. Miller insists that the review was not political and “included groups from across the political spectrum.” Miller also denies that he lied to Congress, saying that he answered their questions truthfully, including those posed in July 2012 while Doug Shulman was still in charge at IRS. (Forbes)

- May 22, 2013: Lerner is summoned to testify in front of the House Committee on Oversight and Government Reform. She makes an appearance, but she ultimately refuses to testify. The committee announces that: “The committee has been contacted by Ms. Lerner’s lawyer, William W. Taylor III, who stated that his client intended to invoke her Fifth Amendment right and refuse to answer questions.” The following day, she is placed on administrative leave. (Forbes)

- May 22, 2013 – former IRS Commissioner Doug Shulman testified that he had frequently visited the White House during 2010-2011, but he denied having discussed the targeting of conservatives with anyone in the White House. His testimony was criticized by several columnists. Some media outlets and lawmakers asserted that Shulman had visited the White House up to 157 times; however, The Atlantic reported that that represented the number of times Shulman was cleared by the Secret Service to visit the White House or the Eisenhower Executive Office Building, not necessarily the number of times Shulman actually arrived; visitor sign-in logs can confirm only 11 visits between 2009 and 2012, though the number is likely higher because the sign-in system does not capture every visitor, particularly at large events. (Infowars.com)

- June 13, 2014 – the IRS notified Republican congressional investigators that it had lost Lerner’s emails from January 2009 to April 2011 because of a mid-2011 computer crash. The emails were under subpoena as part of the congressional investigation. On June 19, the IRS said that the damaged hard drive containing Lerner’s missing emails had been disposed of more than two years prior. Some commentators have raised legal issues concerning how the IRS handled these federal records. A National Archives and Records Administration spokesperson said in an email communication that: “The Office of the Chief Records Officer for the U.S. Government has contacted the IRS to explore specifics of the situation“. (Infowars.com)

June 20, 2013: The news is made public that IRS is set to pay out $70 million in employee bonuses. Taxpayers learn that Lerner received $42,000 (later ends up to be $129,300 bonus. for what?) in bonus money while former Miller received $100,000. Congress is furious and moves to slash the tax agency’s budget by nearly 25%, bringing it to the lowest level in more than ten years. Cuts will remain in place, says Sen. Hal Rogers (R-KY), until IRS makes changes including “abiding by the will of Congress.” (Forbes)

June 20, 2013: The news is made public that IRS is set to pay out $70 million in employee bonuses. Taxpayers learn that Lerner received $42,000 (later ends up to be $129,300 bonus. for what?) in bonus money while former Miller received $100,000. Congress is furious and moves to slash the tax agency’s budget by nearly 25%, bringing it to the lowest level in more than ten years. Cuts will remain in place, says Sen. Hal Rogers (R-KY), until IRS makes changes including “abiding by the will of Congress.” (Forbes)- June 24, 2013: The IRS issues a report into the scandal, admitting fault and saying that “inappropriate criteria” were used for review of organizations applying for tax-exempt status. It blames ineffective management for procedures that remained in place for more than 18 months, resulting in lengthy delays and burdensome requests for information. The IRS also stresses that there is no evidence of intentional wrongdoing, nor any “involvement in these matters by anyone outside of the IRS.” (Forbes)

December 23, 2013: John Koskinen is sworn in as the new IRS Commissioner following a 59-36 confirmation vote. Koskinen is no stranger to playing clean-up: he was brought in as the non-executive chairman of Freddie Mac (FMCC) after the credit crisis. His job description changed after the CEO quit and the CFO committed suicide, and Koskinen added CEO, CFO and chief operating officer to his job title. While at Freddie Mac, Koskinen made a number of friends in Washington. (Forbes)

December 23, 2013: John Koskinen is sworn in as the new IRS Commissioner following a 59-36 confirmation vote. Koskinen is no stranger to playing clean-up: he was brought in as the non-executive chairman of Freddie Mac (FMCC) after the credit crisis. His job description changed after the CEO quit and the CFO committed suicide, and Koskinen added CEO, CFO and chief operating officer to his job title. While at Freddie Mac, Koskinen made a number of friends in Washington. (Forbes)- January 14, 2014: Congressional leaders fume when sources indicate that no criminal charges will be filed by the Federal Bureau of Investigation (FBI) following a lengthy investigation into tax exempt organization scandal. Reportedly, investigators never found evidence of political bias or “enemy hunting” that are considered to be criminal. No criminal charges are ever filed against any IRS employee or official related to this scandal. (Forbes)

May 7, 2014: The House of Representatives passes H. Res. 574 by a vote of 231 to 187, holding Lois Lerner in contempt of Congress “for refusal to comply with a subpoena duly issued by the Committee on Oversight and Government Reform.” About a year later, on March 31, 2015, the Department of Justice announces that has decided not pursue criminal contempt charges against Lerner. The DOJ found that she had not waived her Fifth Amendment rights. (Forbes)

May 7, 2014: The House of Representatives passes H. Res. 574 by a vote of 231 to 187, holding Lois Lerner in contempt of Congress “for refusal to comply with a subpoena duly issued by the Committee on Oversight and Government Reform.” About a year later, on March 31, 2015, the Department of Justice announces that has decided not pursue criminal contempt charges against Lerner. The DOJ found that she had not waived her Fifth Amendment rights. (Forbes)- On July 9, 2014, Republicans released an April 13, 2013 email from Lerner in which she cautioned colleagues to “be cautious about what we say in emails,” citing congressional inquiries. The email did not specify which congressional inquiries Lerner was concerned about and made no mention of the then-impending TIGTA report. Republicans said that this email suggested that Lerner tried to hide evidence from investigators.

- September 5, 2014 – the IRS said it lost additional emails of five workers under congressional investigation, blaming computer crashes. These five workers include two people based in Cincinnati who worked on tea party cases; according to the IRS the crashes all predate congressional investigations and had occurred between September 2009 and February 2014. (Infowars.com)

- September 5, 2014 – the Senate Permanent Subcommittee on Investigations released its report on the IRS Tea Party Scandal. The subcommittee’s majority report, authored by subcommittee chairman Senator Carl Levin and submitted for the subcommittee’s Democrats, concurred with TIGTA’s finding that inappropriate screening criteria were used but concluded that there was no intentional wrongdoing or political bias in the use of the criteria. The majority faulted TIGTA for omitting from its report that liberal groups were also selected for additional screening and that previous TIGTA inquiries found no indication of political bias at the IRS. The subcommittee’s Republican minority submitted a dissenting report authored by ranking member Senator John McCain which broadly validated the TIGTA report and accused the majority of minimizing bias against conservative groups, noting that most of the groups targeted for additional scrutiny were conservative. (Infowars.com)

- January 2015, -In accordance with the White house denials of any knowledge of the IRS Tea Party Scandal, the United States Senate requested that the White House produce all communications it has had with the IRS since 2010. (Infowars.com)

- February 26, 2015: Treasury Deputy Inspector General Timothy Camus confirms that TIGTA is investigating whether the disappearance of emails belonging to Lerner could be linked to criminal activity. While the IRS turned over 67,000 Lerner emails, says IRS Commissioner Koskinen, emails before April 2011 went missing: those were important because they span the time period from the creation of the BOLO lists to the time period that Lerner was advised of the practice (sometime in early 2011). (Forbes)

- June 2015 – Regarding the 26,000 deleted and missing emails: As AP reports, according to the IG’s deputy Timothy Camus, two “lower-graded” employees at the IRS center in Martinsburg, West Virginia, erased 422 computer backup tapes that contained as many as 24,000 emails to and from former IRS official Lois Lerner. It gets better: the tapes were erased in March 2014, months after congressional investigators requested all of Lerner’s emails, and months after Zero Hedge, among many others, said to simply track down the server backups. And the punchline: according to George, who before “investigating” IRS crimes, was a page for the 1980 Democratic National Convention and a founder of the Howard University College Democrats, the workers might be incompetent, a lead investigator said Thursday, but there is no evidence they were part of a criminal conspiracy to destroy evidence. “When interviewed, those employees said, `Our job is to put these pieces of plastic into that machine and magnetically obliterate them. We had no idea that there was any type of preservation (order) from the chief technology officer,’” Camus told the committee. (Infowars.com)

October 23, 2015: The DOJ advises Congress that it is closing its investigation and confirms it will not recommend criminal charges against Lois Lerner or any IRS official. The investigation finds “substantial evidence of mismanagement, poor judgment and institutional inertia leading to the belief by many tax-exempt applicants that the IRS targeted them based on their political viewpoints” inside IRS. “Poor management,” said Assistant Attorney General Peter Kadzik, “is not a crime.” (Forbes)

October 23, 2015: The DOJ advises Congress that it is closing its investigation and confirms it will not recommend criminal charges against Lois Lerner or any IRS official. The investigation finds “substantial evidence of mismanagement, poor judgment and institutional inertia leading to the belief by many tax-exempt applicants that the IRS targeted them based on their political viewpoints” inside IRS. “Poor management,” said Assistant Attorney General Peter Kadzik, “is not a crime.” (Forbes)- May 20, 2016: Judiciary Committee Chairman Bob Goodlatte (R-VA) announces there would be hearings to “examine misconduct by the Internal Revenue Service (IRS) Commissioner John Koskinen. He stops short of calling for an impeachment. A few days later, Rep. Elijah Cummings, Ranking Member of the House Oversight Committee, claims that the investigation into the IRS handling of the tax-exempt scandal has cost taxpayers $20 million. (Forbes)

- In May 2016, the IRS finally released its full list of conservative groups it unfairly scrutinized totaling a whopping 426 organizations. The Washington Times offered some insight into how the IRS searched for keywords when singling out groups. Sixty of the groups on the list released last month have the word “tea” in their name, 33 have “patriot,” eight refer to the Constitution, and 13 have “912” in their name — which is the monicker of a movement started by conservatives. Another 26 group names refer to “liberty,” though that list does include some groups that are not discernibly conservative in orientation.

June 15, 2016: The House Oversight Committee votes to censure IRS Commissioner John Koskinen. A June 22 hearing by the House Judiciary Committee (the second such hearing) will consider a resolution to impeach Koskinen. The full House must vote to impeach an official; to be removed from office requires a 2/3 vote of the Senate. No agency official has been impeached in over 140 years: the last was Secretary of War William Belknap, under President Ulysses Grant in 1876. (Forbes)

June 15, 2016: The House Oversight Committee votes to censure IRS Commissioner John Koskinen. A June 22 hearing by the House Judiciary Committee (the second such hearing) will consider a resolution to impeach Koskinen. The full House must vote to impeach an official; to be removed from office requires a 2/3 vote of the Senate. No agency official has been impeached in over 140 years: the last was Secretary of War William Belknap, under President Ulysses Grant in 1876. (Forbes)- June 22, 2016: ”We’re moving into uncharted waters,” Michael J. Gerhardt, a UNC Chapel Hill constitutional law professor, tells the Judiciary House Committee. Testifying about potential impeachment charges against IRS Commissioner Koskinen, Gerhardt said, “The House has never impeached a sub-Cabinet official. I would urge everyone here to look at alternatives.” He testified “the Founders did not want high-ranking officials in the executive or judicial branches to be subject to impeachment for their mistakes in office,” suggesting impeachment be reserved for more serious offenses. Koskinen did not attend the hearing, and the IRS did not release an official comment on the proceedings. (Forbes)

Commissioner Steven Miller was forced to resign during the scandal and Lois Lerner, the IRS’ former director of the Exempt Organizations Unit, was placed on administrative leave. She eventually resigned with a $129,000 bonus for her good work and a fat pension to boot, plus she and the larger agency escaped any charges following a Department of Justice investigation in spite of overwhelming evidence of criminal activity.

IRS Commissioner John Koskinen, a big democratic donor who was the 2013 appointee as IRS Commissioner, has yet to face any real consequences for stonewalling Congress’s investigation into his agency’s bias either. After the Justice Department notified Congress in October 2015 that there would be no charges against Lois Lerner or anyone else in the IRS, 19 Republican members of the House Oversight and Government Reform Committee led by the Committee’s Chairman, Jason Chaffetz (R-Utah), filed a resolution to impeach Koskinen.

Those sponsoring the impeachment resolution to remove Koskinen from office accused him of failing to prevent the destruction of evidence in allowing the erasure of back-up tapes containing thousands of e-mails written by Lois Lerner, and of making false statements under oath to Congress. In a statement released by the Committee, Chaffetz said Koskinen “failed to comply with a congressionally issued subpoena, documents were destroyed on his watch, and the public was consistently misled. Koskinen told Congress that no e-mails involved in the case had been destroyed since the current investigation was opened. In fact, e-mails and backup tapes duplicating those e-mails were destroyed with some vigor after the investigation began, and were being destroyed at least as late as 2014.

Impeachment is the appropriate tool to restore public confidence in the IRS and to protect the institutional interests of Congress.” The IRS said on October 27 that it did not have an immediate comment on the impeachment resolution. The resolution was referred to the House Judiciary committee, who held hearings on the matter on May 23 and June 22, 2016. The House leadership decided not to proceed any further which led to a discharge petition.

The rabbit hole goes much deeper with the IRS Scandal. Read the book below to discover the truth…

The IRS scandal is far more complicated than it appears—and more pernicious. Its roots go back to its founding but modern technology has accelerated the harm that a few malicious IRS administrators can do to their political enemies.

The IRS scandal is far more complicated than it appears—and more pernicious. Its roots go back to its founding but modern technology has accelerated the harm that a few malicious IRS administrators can do to their political enemies.

Leaking sensitive information about individuals and organizations is par for the course for committed ideologues in the Obama Administration who rely on an apparatus of far left think tanks and their allies in the press to spin narratives that keep the Washington elite in control. The far left’s friends in Congress and the IRS, meanwhile, are doing everything they can to make sure the truth is never brought to light by spinning about what really happened.

This Broadside will expose the tax collector conspiracy that kneecapped the Tea Party, one of the greatest citizen uprisings in American history, and educates citizens about what has been done so that they might prevent it from ever happening again. Knowledge, particularly of the arcane regulations of the tax code, is power; a lawless tax collector class can only be curtailed by an active citizenry. The Truth About the IRS Scandals is necessary because only the truth will set Americans free.